At Lancorp Tax Solutions, we offer expert-led, accurate, and hassle-free Income Tax Return (ITR) Filing Services — helping individuals, professionals, and businesses file their tax returns on time, with maximum benefits and full legal compliance.

Whether you’re a salaried individual, business owner, freelancer, or corporate entity, our tax experts ensure your returns are filed error-free, deductions are maximized, and risks of scrutiny or penalties are minimized.

Our Income Tax Return Filing Services

We offer end-to-end ITR filing support, tailored to your unique income profile:

🔹 1. Individual ITR Filing (ITR-1 to ITR-4)

For salaried employees, freelancers, pensioners, and small business owners with different income sources.

Claim all deductions, get refunds quickly, and stay compliant.

🔹 2. Business & Corporate ITR Filing (ITR-5 to ITR-7)

We file returns for partnerships, LLPs, private limited companies, NGOs, and trusts — with complete financial reporting and disclosures.

Accurate tax compliance for every business structure.

🔹 3. Capital Gains & Investment Income Filing

Reporting gains from stocks, mutual funds, property, crypto, and other investments — with proper indexation and exemption planning.

Pay the right tax, save with smart exemptions.

🔹 4. Foreign Income & NRI Tax Filing

ITR filing for individuals with foreign income, assets abroad, or NRI/OCI status — including DTAA claims and FEMA compliance.

Cross-border tax compliance made easy.

🔹 5. Freelancers, Consultants & Gig Workers

Tax return preparation for professionals with variable income, 1099-style earnings, or project-based revenue.

ITR tailored for modern income streams.

🔹 6. ITR Filing with Tax Audit (Sec 44AB)

We handle complex ITR filings that require tax audit under law — complete with Form 3CD disclosures and reconciliations.

Audit + ITR = One seamless, compliant package.

🔹 7. Revised, Belated & Rectification Filings

Missed the deadline or need to correct an error? We help with revised, belated, and rectified return filings.

Fix mistakes before they become penalties.

Why File ITR with Lancorp?

🔹 Expert-Led Filing – Chartered Accountants and tax experts on every case

🔹 Maximum Deductions – We help you claim all eligible benefits under Sections 80C, 80D, 24(b), etc.

🔹 Error-Free Filing – Reviewed and validated returns with zero mismatch risk

🔹 Fast Refund Processing – Optimize your return for quicker credit from the IT Department

🔹 Complete Confidentiality – Your financial data is safe and secure with us

🔹 PAN-India & Global Support – For residents, NRIs, and foreign income holders

Who Should File an Income Tax Return?

We assist a wide variety of clients, including:

🔹 Salaried Employees

🔹 Freelancers & Consultants

🔹 Business Owners & Shopkeepers

🔹 Startups & Corporates

🔹 NRIs & OCI Card Holders

🔹 Property Investors & Traders

🔹 Professionals (Doctors, Lawyers, CAs)

🔹 Trusts, NGOs, and Societies

Documents Required for ITR Filing

Here’s a snapshot of what we typically need:

🔹 PAN, Aadhaar, and Bank Details

🔹 Form 16 / Salary Slips

🔹 Capital Gains Statements

🔹 Business Income Books or Presumptive Income Declaration

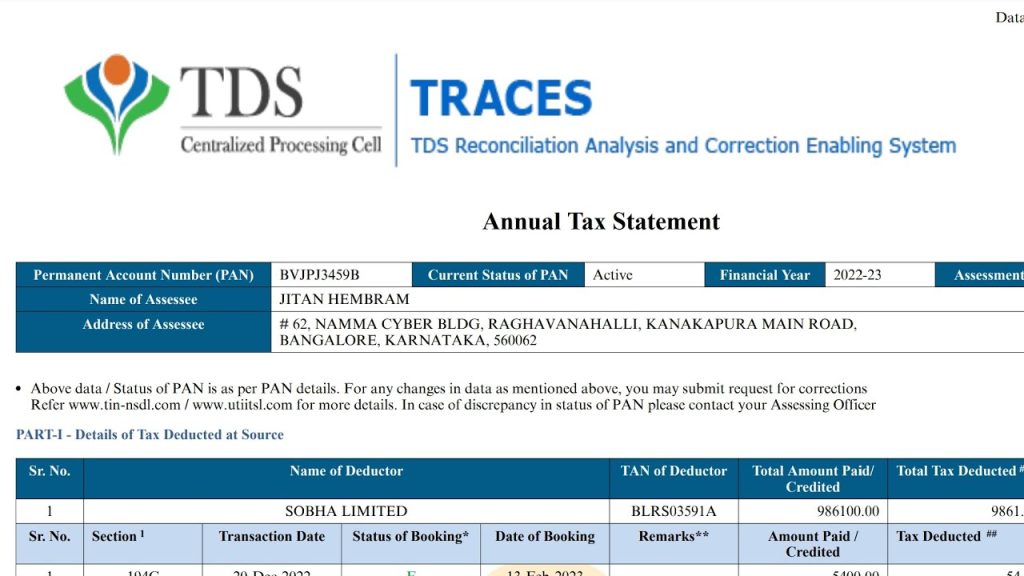

🔹 TDS Certificates (Form 16A / Form 26AS)

🔹 Investment Proofs (80C/80D, etc.)

🔹 Foreign Asset/Income Disclosure (if applicable)

Tools & Platforms We Use

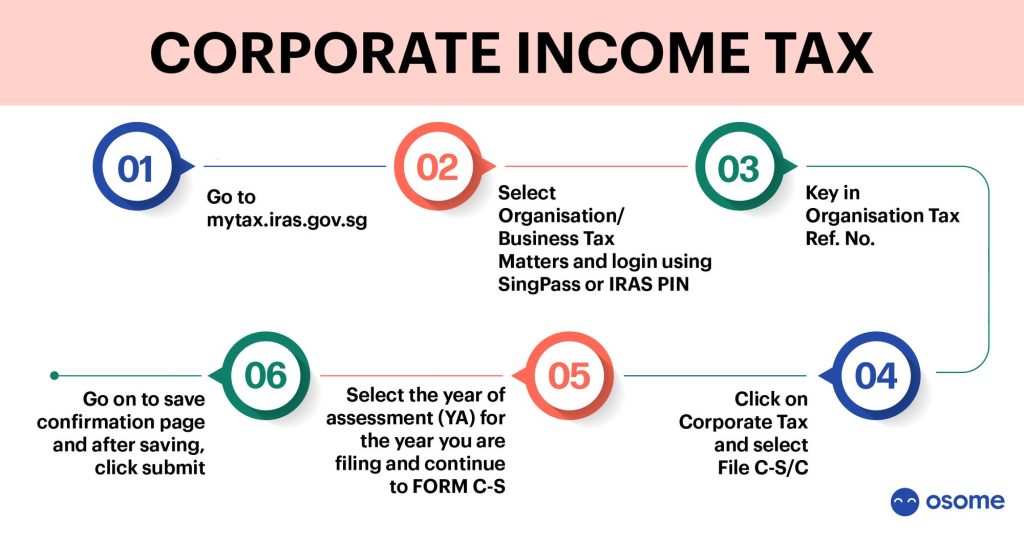

🔹 Income Tax Portal (New) – For return filing and e-verification

🔹 TRACES – For TDS reconciliation

🔹 Cleartax, Winman, Zoho Books, Tally – For calculations and reports

🔹 Communication – WhatsApp, Zoom, Google Meet, Email