At Lancorp Tax Solutions, we offer fast, accurate, and compliant GST Returns Filing Services — helping businesses of all sizes stay fully aligned with GST regulations, avoid penalties, and maintain seamless tax compliance.

Whether you’re a small business, startup, or large enterprise, our experienced GST professionals ensure your returns are filed on time, input tax credits are maximized, and reconciliations are accurate — every month, quarter, and year.

Our GST Returns Filing Services

We offer complete end-to-end GST compliance and filing support:

🔹 1. Monthly & Quarterly GST Returns Filing (GSTR-1, GSTR-3B)

Preparation and timely filing of outward and summary returns for regular taxpayers under normal or QRMP scheme.

Stay compliant, avoid late fees and interest.

🔹 2. Annual Return Filing (GSTR-9 & GSTR-9C)

We help prepare and file your annual GST returns with audit, reconciliation, and certification (if applicable).

Get it right — one time, every time.

🔹 3. Input Tax Credit (ITC) Reconciliation

Match your purchase register with GSTR-2B/2A and resolve mismatches to claim maximum eligible ITC.

Boost working capital with optimized credit claims.

🔹 4. GST Audit Assistance

For businesses with turnover above the audit threshold or under departmental scrutiny, we prepare reconciliations and assist in audits.

Full support during GST audit and assessments.

🔹 5. Composition Scheme Filing (GSTR-4, CMP-08)

Quarterly and annual return filing for businesses registered under the GST composition scheme.

Simplified compliance for small traders and service providers.

🔹 6. NIL Returns & Non-Operational Filings

Avoid penalties by filing NIL returns on time, even if there’s no business activity.

Non-filing is a risk — we keep you 100% compliant.

🔹 7. GST Registration & Amendments

Need a new GST registration or changes in existing GST data? We handle end-to-end filing and department follow-up.

Start right and update when needed.

Why File GST Returns with Lancorp?

🔹 Qualified GST Experts & Chartered Accountants – Deep expertise in GST law & filing

🔹 On-Time Filing, Every Time – Never miss a deadline with our proactive filing schedules

🔹 Input Tax Credit Optimization – Maximize eligible credit and improve cash flow

🔹 Error-Free Filing – Prevent notices, penalties, and department scrutiny

🔹 Dedicated Relationship Manager – One point of contact for all your GST matters

🔹 Cloud-Based Processes – Share documents securely and file returns from anywhere

Who Needs to File GST Returns?

Our GST filing services are tailored for:

🔹 Traders & Manufacturers

🔹 Service Providers & Freelancers

🔹 E-Commerce Sellers

🔹 Transport & Logistics Businesses

🔹 Retail Chains & Distributors

🔹 Real Estate & Construction

🔹 Professionals (Doctors, Consultants, Lawyers)

🔹 NGOs & Educational Institutions

Types of GST Returns We Handle

Return Type Purpose Frequency

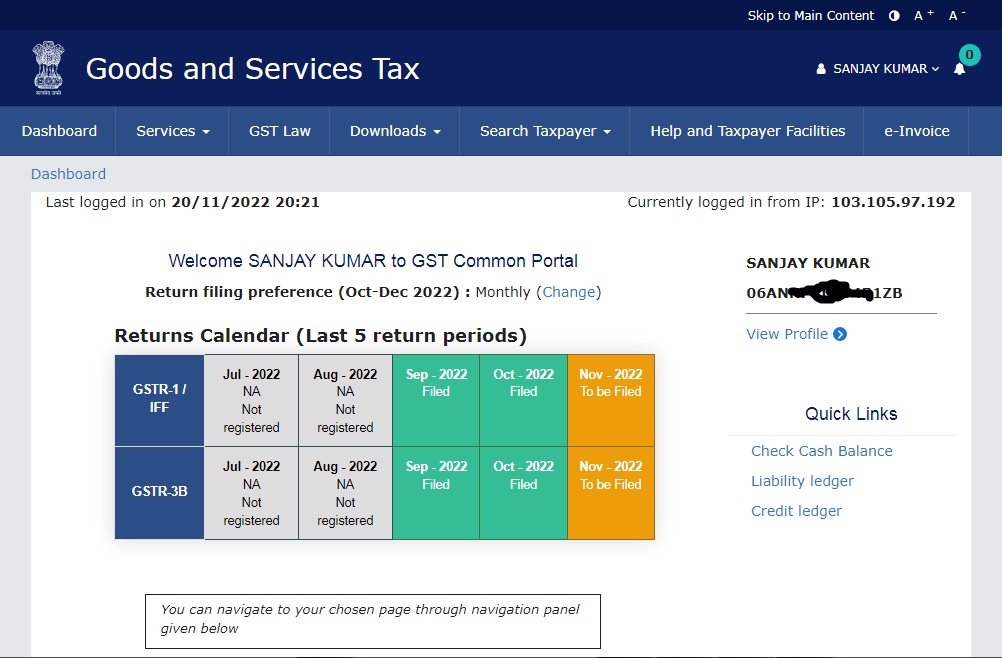

🔹 GSTR-1 Outward supplies/sales Monthly / Quarterly

🔹 GSTR-3B Summary return Monthly

🔹 GSTR-4 Composition Scheme Annual

🔹 CMP-08 Composition Return Quarterly

🔹 GSTR-9 Annual Return Annually

🔹 GSTR-9C Reconciliation & Audit Report Annually

🔹 GSTR-10 Final Return (on cancellation) Once

🔹 GSTR-11 UIN holders (Embassies/UN bodies) Monthly

Documents Required for GST Filing

🔹 Sales & Purchase Invoices

🔹 Debit/Credit Notes

🔹 E-Way Bills (if applicable)

🔹 Bank Statements

🔹 Input Credit Registers

🔹 Previous Return Filings

🔹 GST Portal Credentials

Tools & Platforms We Work With

🔹 Government Portals: GSTN, ICEGATE, e-Invoice Portal

🔹 Software: Tally, Zoho Books, Busy, Marg ERP

🔹 Reconciliation Tools: ClearGST, Gen GST, Excel-based MIS

🔹 Communication: WhatsApp, Google Drive, Zoom, Email