At Lancorp Tax Advisors, we specialize in Internal Tax Audit Services — helping businesses proactively review, assess, and strengthen their tax processes and compliance before external authorities ever knock on the door.

Our internal audits go beyond surface-level checks — we deep-dive into your tax controls, documentation, reconciliations, and systems to uncover hidden risks, plug compliance gaps, and optimize your tax position.

Whether you’re a startup scaling operations or a large enterprise managing complex transactions, we ensure your tax ecosystem is robust, reliable, and audit-ready at all times.

Our Internal Tax Audit Services

We offer comprehensive internal tax audit and diagnostic review services, including:

🔹 1. Internal Review of Direct & Indirect Taxes

End-to-end review of income tax, GST, TDS, and other statutory obligations to ensure accurate filings and disclosures.

Identify issues before they become liabilities.

🔹 2. GST Internal Audit & Input Reconciliation

Check GSTR filings, input tax credit claims, and vendor compliance to prevent ITC loss and reduce risks of departmental audits.

Maximize credit. Minimize exposure.

🔹 3. Income Tax Health Check

Analyze ITR filings, advance tax, MAT computations, and deferred tax provisions to validate accuracy and identify under/over-payments.

Keep your tax filings accurate and defensible.

🔹 4. TDS/TCS Compliance Review

Evaluate deductions, rates, payments, and returns to detect defaults, delays, or mismatches with Form 26AS and TRACES.

Avoid interest, late fees, and departmental scrutiny.

🔹 5. SOP & Process Evaluation

Audit internal tax processes, documentation practices, and control mechanisms to align with best practices and legal standards.

Build a stronger compliance culture from within.

🔹 6. Risk & Exposure Identification

Uncover potential exposures related to non-compliance, misclassification, or procedural lapses and suggest corrective measures.

Early detection = easier resolution.

🔹 7. Reporting & Corrective Action Plans

We provide detailed internal audit reports with actionable insights, risk ratings, and a compliance roadmap.

Insights that lead to real improvements.

Why Choose Lancorp for Internal Tax Audits?

🔹 Qualified Chartered Accountants & Tax Experts – Audit specialists with deep domain knowledge across direct and indirect tax laws

🔹 Preventive Audit Approach – We help you fix issues before regulators or external auditors find them

🔹 Tailored Audit Plans – Risk-based, sector-specific internal audit procedures

🔹 Process-Driven Reviews – We evaluate not just numbers, but systems, documentation, and workflows

🔹 Confidential & Independent – Objective internal evaluations with full confidentiality and integrity

Industries We Serve

We conduct internal tax audits across multiple sectors, including:

🔹 Manufacturing & Engineering

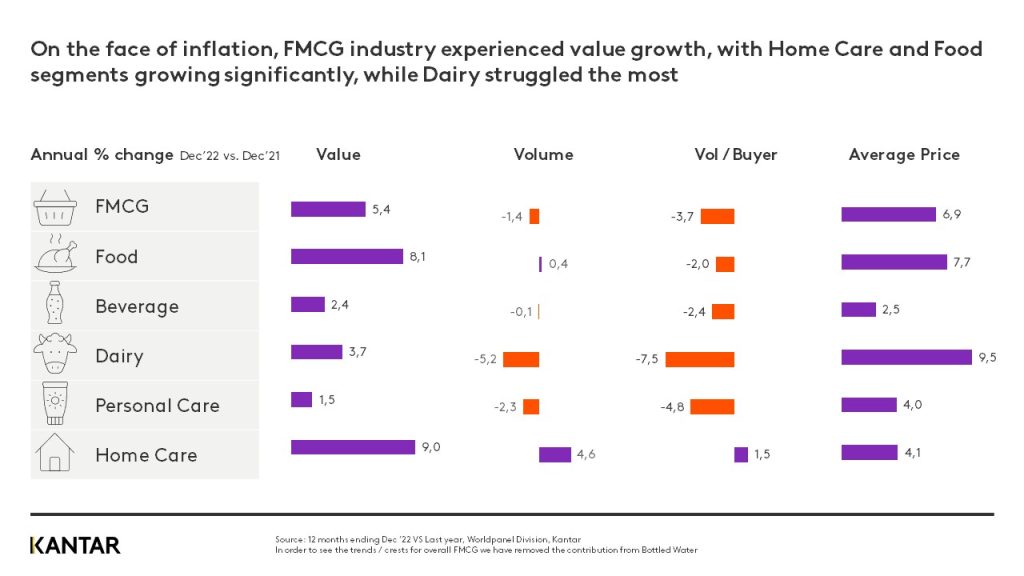

🔹 FMCG, Retail & E-commerce

🔹 Software & Technology Companies

🔹 Logistics & Warehousing

🔹 Healthcare & Diagnostics

🔹 Construction & Real Estate

🔹 Education & NGOs

🔹 Professional Services (CA, Legal, Consulting Firms)

Tools & Platforms We Use

We use industry-standard tools to deliver efficient, reliable audit services:

🔹 Accounting Software: Tally, QuickBooks, Zoho Books, SAP, Oracle

🔹 Tax Compliance Platforms: ClearTax, GST Hero, TRACES, GSTN

🔹 Audit Tools: Excel, Power BI, Google Sheets, CaseWare

🔹 Documentation & Tracking: Notion, Google Drive, Dropbox

🔹 Collaboration: Zoom, Slack, Microsoft Teams