At Lancorp Tax Consultants, we specialize in comprehensive domestic taxation services — helping individuals, startups, SMEs, and large enterprises navigate complex tax regulations with clarity, compliance, and confidence.

Whether you’re filing annual returns, optimizing tax structures, or resolving disputes, our experienced tax professionals ensure your obligations are met, risks are minimized, and financial outcomes are optimized.

Our Domestic Taxation Services

We provide a full spectrum of tax consulting and compliance services, including:

🔹 1. Income Tax Advisory & Filing

We assist individuals and businesses with accurate, timely, and compliant income tax filing.

Stay stress-free during tax season — we handle everything for you.

🔹 2. Tax Planning & Optimization

Strategic tax planning for businesses and professionals to legally minimize liabilities and maximize savings.

Reduce your tax burden with smart, proactive planning.

🔹 3. GST Registration & Compliance

Complete assistance with GST registration, returns filing (GSTR-1, GSTR-3B, etc.), input tax credit management, and reconciliation.

Stay GST-compliant and avoid penalties.

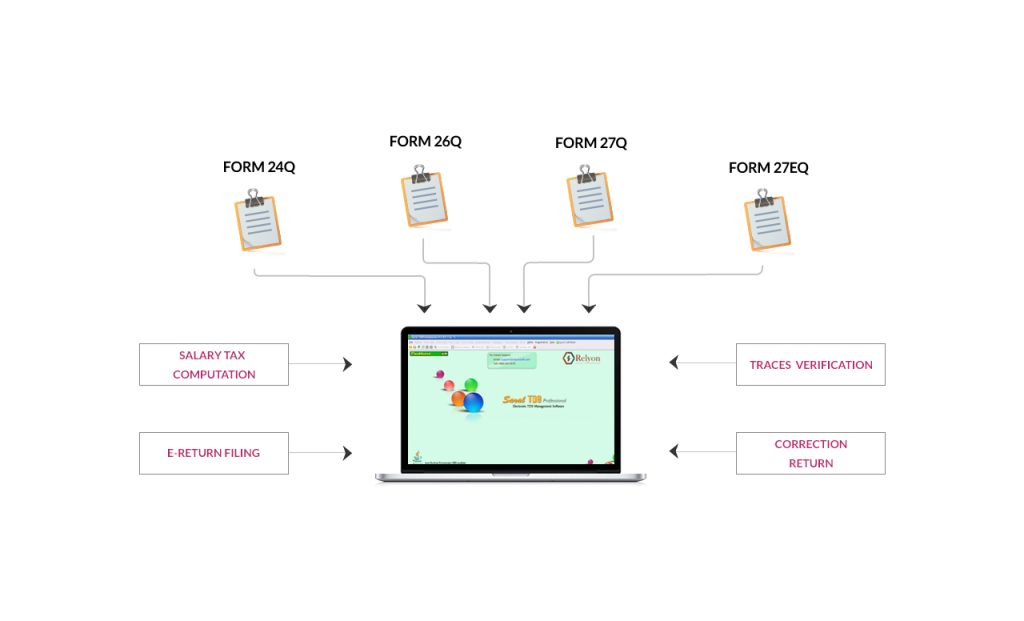

🔹 4. TDS/TCS Management

Ensure proper deduction, payment, and filing of TDS/TCS with accurate returns and timely compliance.

Avoid interest and notices with streamlined TDS management.

🔹 5. Tax Assessments & Litigation Support

Expert support during tax assessments, scrutiny notices, or appeals before tax authorities and tribunals.

We defend your case with precision and expertise.

🔹 6. Business Structuring for Tax Efficiency

We help you choose the right business structure — Proprietorship, Partnership, LLP, or Pvt Ltd — to optimize tax benefits and compliance.

Structure your business smartly from the start.

🔹 7. Corporate Tax Compliance

Complete tax lifecycle management for companies — including advance tax computation, MAT calculations, and statutory reporting.

Compliance without compromise.

Why Choose Lancorp for Domestic Taxation?

🔹Certified Tax Experts – Chartered Accountants, tax advisors, and legal experts on one team

🔹Up-to-Date Knowledge – We stay current with evolving tax laws, circulars, and case rulings

🔹Digital Filing & Automation – Efficient e-filing, digital records, and cloud-based systems

🔹Customized Advice – Every client gets tailored tax strategies, not just standard templates

🔹Compliance-First Approach – Minimize risk, penalties, and tax-related headaches

Industries We Serve

Our taxation experts support businesses and individuals across various sectors:

🔹 Manufacturing & Trading

🔹 IT & Software Services

🔹 Construction & Real Estate

🔹 Healthcare & Diagnostics

🔹 Education & Coaching Institutes

🔹 Hospitality & Tourism

🔹 E-commerce & Retail

🔹 Professional Services (Doctors, Lawyers, Freelancers)

🔹 NGOs & Trusts

Tax & Compliance Tools We Use

We leverage modern software and tools for accuracy, speed, and compliance:

🔹 Tax Software: ClearTax, Winman, Tally, Zoho Books

🔹 GST Filing: GSTN Portal, IRIS, GST Hero

🔹 TDS Management: TRACES Portal, Saral TDS

🔹 Accounting & Reconciliation: Tally, QuickBooks, Busy, Marg

🔹 Communication: Google Workspace, Zoom, WhatsApp

🔹 Analytics & Reporting: Excel, Power BI, Google Sheets